Laptop Murah Dengan Garansi Resmi Untuk Keamanan Pembelian

Laptop Murah Dengan Garansi Resmi Untuk Keamanan Pembelian menjadi pertimbangan utama bagi calon pembeli. Memiliki laptop dengan harga terjangkau tentu menggiurkan, namun keamanan pembelian dan jaminan kualitas sangat penting. Artikel ini akan membahas berbagai aspek penting dalam memilih laptop murah yang tetap memberikan rasa aman berkat adanya garansi resmi, mulai dari merk yang direkomendasikan hingga

Metode Menabung Dengan Sistem 50-30-20

Metode Menabung Dengan Sistem 50-30-20 adalah panduan praktis untuk mengelola keuangan pribadi secara efektif. Sistem ini membagi penghasilan Anda menjadi tiga bagian: 50% untuk kebutuhan pokok, 30% untuk keinginan, dan 20% untuk tabungan dan investasi. Dengan menerapkan metode ini, Anda dapat mencapai tujuan keuangan lebih cepat, mengurangi stres keuangan, dan membangun masa depan yang lebih

Laptop Murah Dengan Desain Yang Elegan Dan Modern

Laptop Murah Dengan Desain Yang Elegan Dan Modern, impian yang kini menjadi kenyataan! Bayangkan, sebuah perangkat canggih dengan tampilan memukau, tanpa harus menguras isi dompet. Artikel ini akan membedah dunia laptop terjangkau yang tak hanya unggul dalam performa, namun juga memanjakan mata dengan desainnya yang modern dan elegan. Siap-siap terpukau! Dari merk-merk ternama hingga spesifikasi

Cara Mengatasi Android Yang Tidak Bisa Terhubung Ke Perangkat Eksternal

Cara Mengatasi Android Yang Tidak Bisa Terhubung Ke Perangkat Eksternal? Duh, rasanya seperti pacaran yang gagal: sudah berusaha sekuat tenaga, eh malah di-ghosting sama flashdisk! Ponsel Android kesayangan tiba-tiba menolak mentah-mentah perangkat eksternal? Jangan panik, masalah ini lebih sering terjadi daripada yang kamu kira. Artikel ini akan memandu kamu melewati labirin koneksi yang bermasalah, dari

Analisis Keuntungan Usaha Budidaya Kerang Hijau

Analisis Keuntungan Usaha Budidaya Kerang Hijau: Siapa sangka, makhluk mungil berkulit keras ini menyimpan potensi keuntungan yang luar biasa? Dari sekadar makanan lezat, kerang hijau menjelma menjadi peluang bisnis yang menggiurkan. Mari kita selami dunia budidaya kerang hijau, ungkap rahasia keuntungannya, dan temukan strategi jitu untuk meraih kesuksesan di dalamnya. Siap-siap tercengang dengan potensi keuntungannya!

Smartphone Budget Friendly Dengan Fitur Ir Blaster

Smartphone Budget Friendly Dengan Fitur IR Blaster? Wuih, mantap! Bayangin aja, gak perlu lagi ribet-ribet nyari remote TV, AC, atau kipas angin. Cukup pake HP murah meriah yang punya fitur IR Blaster ini, semua bisa dikendalikan. Asyik banget kan, cuy? Ini dia review lengkap tentang smartphone budget friendly dengan fitur canggih ini, pasti bikin hidup

Hp Gaming Murah Terbaik Untuk Game Online

HP Gaming Murah Terbaik Untuk Game Online menjadi pertimbangan utama bagi para gamer yang ingin menikmati pengalaman bermain game online tanpa perlu merogoh kocek terlalu dalam. Artikel ini akan membahas secara komprehensif berbagai aspek penting dalam memilih HP gaming murah, mulai dari spesifikasi hingga performa dan pengalaman bermain game secara keseluruhan. Analisis mendalam terhadap berbagai

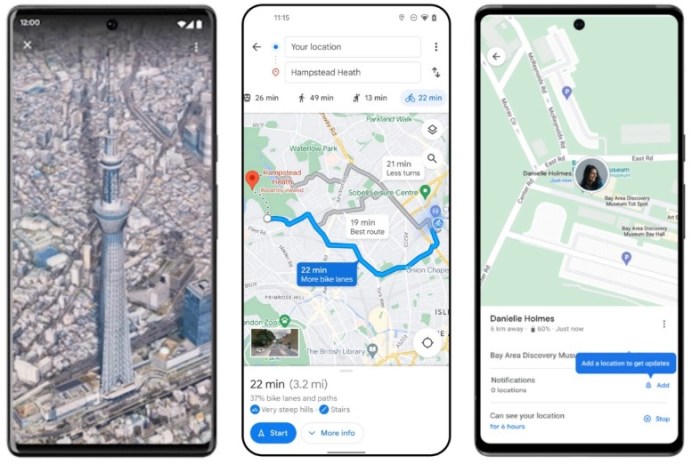

Cara Menggunakan Fitur Google Maps Di Android

Cara Menggunakan Fitur Google Maps Di Android? Eh, cuy, nggak usah bingung lagi kalo lagi nyasar di Pontianak! Google Maps ini kayak jurus sakti, bisa bantu cari jalan, nemu tempat makan enak, bahkan liat pemandangan 360 derajat! Pokoknya, aplikasi ini wajib banget ada di HP kamu, mau jalan-jalan atau cuma mau nganter temen ke rumah.

Hp Harga 1,5 Jutaan Dengan Fitur Nfc Dan Fingerprint

HP Harga 1,5 Jutaan Dengan Fitur NFC dan Fingerprint menjadi incaran banyak konsumen. Kehadiran fitur NFC dan fingerprint pada ponsel kelas menengah ini semakin mempermudah transaksi digital dan menjaga keamanan data pribadi. Artikel ini akan mengulas berbagai pilihan HP dengan spesifikasi menarik di rentang harga tersebut, membandingkan fitur unggulannya, serta memberikan rekomendasi sesuai kebutuhan pengguna.

Laptop Murah Dan Tahan Banting Untuk Penggunaan Aktif Pelajar

Laptop Murah Dan Tahan Banting Untuk Penggunaan Aktif Pelajar menjadi kebutuhan penting bagi pelajar modern. Memilih laptop yang tepat memerlukan pertimbangan matang terhadap spesifikasi, daya tahan, dan anggaran. Artikel ini akan memandu Anda dalam memilih laptop ideal yang mampu mendukung aktivitas belajar intensif sekaligus tahan terhadap penggunaan sehari-hari yang cukup berat. Dari pemilihan material bodi

- 1

- 2